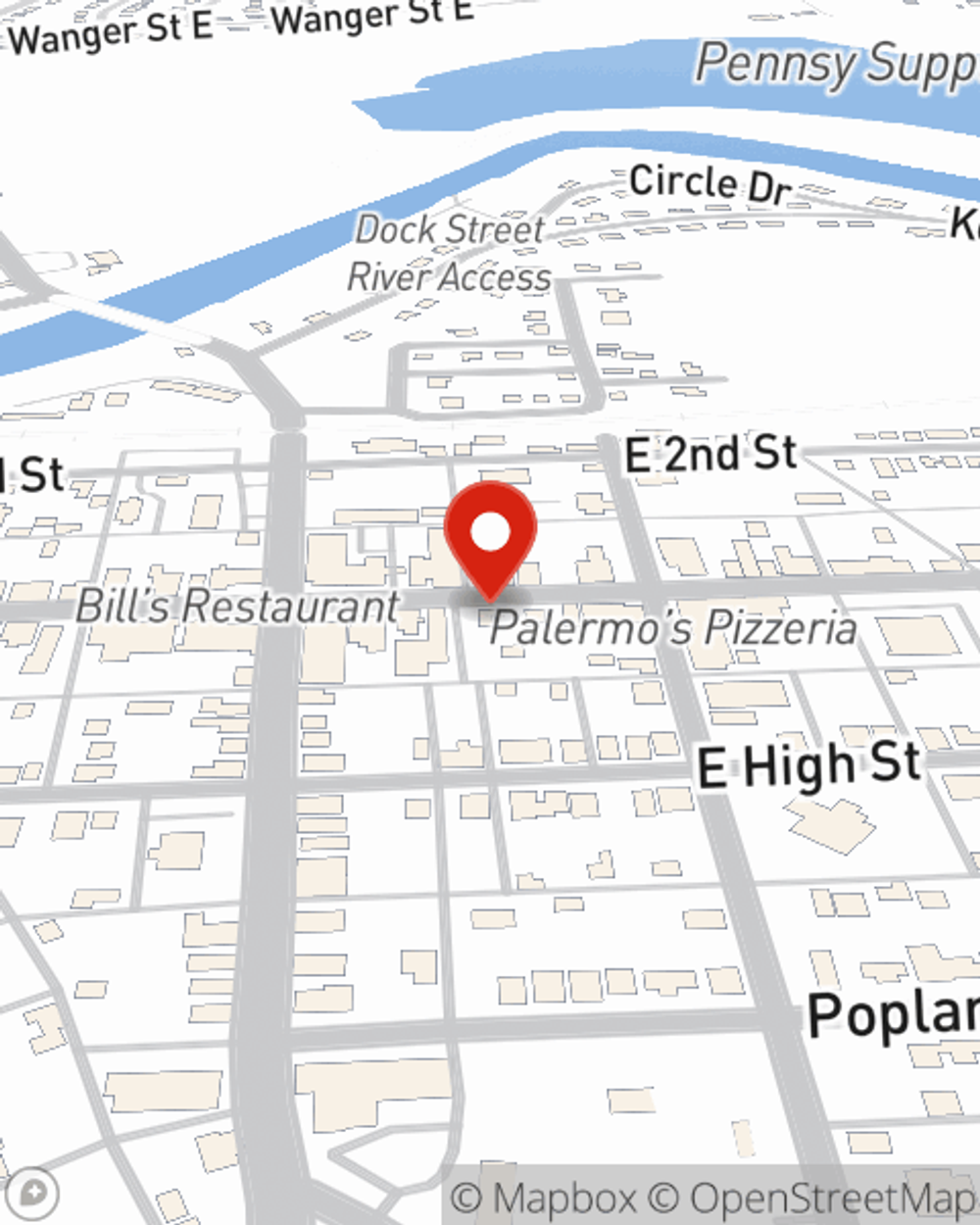

Business Insurance in and around Hummelstown

Searching for insurance for your business? Look no further than State Farm agent Lindsey Cline!

No funny business here

Coverage With State Farm Can Help Your Small Business.

Running a small business comes with a unique set of highs and lows. You shouldn't have to wrestle with those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, extra liability coverage and business continuity plans, among others.

Searching for insurance for your business? Look no further than State Farm agent Lindsey Cline!

No funny business here

Protect Your Future With State Farm

Whether you own an ice cream shop, a lawn care service or an art gallery, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Lindsey Cline today, and let's get down to business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Lindsey Cline

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.